NZ house prices could go higher if for no other reason than massive increases in money supply and low interest rates causing a huge demand shock on everything from timber and metals, to shipping capacity and labour shortages.

Many people think the supply shortage is due to factories not being at full capacity. This is not the case. Chinese production is 20% higher, and exports a full 40% higher, than at the start of 2020. Yet despite this surge in supply, it’s still not enough to keep up with demand. As a result, developed world goods prices are exploding because demand has pushed the global supply chain to extremes.

With shortages of almost everything and costs rising, I expect houses prices to continue to rise, though probably not at the crazy growth rates we’ve seen recently caused the NZ Reserve Banks mistakes, keeping rates too low for too long. The RBNZ has been surprised by the rise in house prices and low unemployment. It comes as no surprise to me or anyone I speak to. Perhaps Adrian Orr should spend more time speaking to business owners and less time meetings with politicians in Wellington.

John Kenel

Assured Property

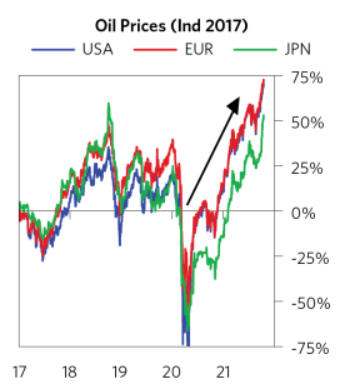

Chart Source: Bridgewater Associates

#assuredproperty #housing #rentals #propertyinvestment