I hope many of you were able to enjoy the holidays as much as I did. My highlight was walking the Milford Track, an incredible family adventure.

It’s time to get back to work. We’ve got a busy year planned with over 200 investment properties already locked in for delivery to our customers. We are also on the lookout for more development land. The development process from land acquisition, through design and engineering, to resource, subdivision, building and engineering consents, grows more complex and time consuming each year, so it’s necessary to plan further ahead.

We have a new staff member starting shortly. A very experienced executive assistant who will work me so I have more time to read, research and write about the property market. I will continue to be very involved in land acquisition and design to ensure we are delivering the right type of property for our customers.

Here’s my take on where the Hamilton Housing Market is headed in 2020:

Despite a number of niggles, the NZ and Global economies are on track for another year of reasonable growth. I’m expecting a 5-7% increase in houses prices in Hamilton.

Elections in the NZ and US will create some uncertainty, but overall the effect on markets will be positive, mainly due a raft of promises politicians will make to try and buy votes.

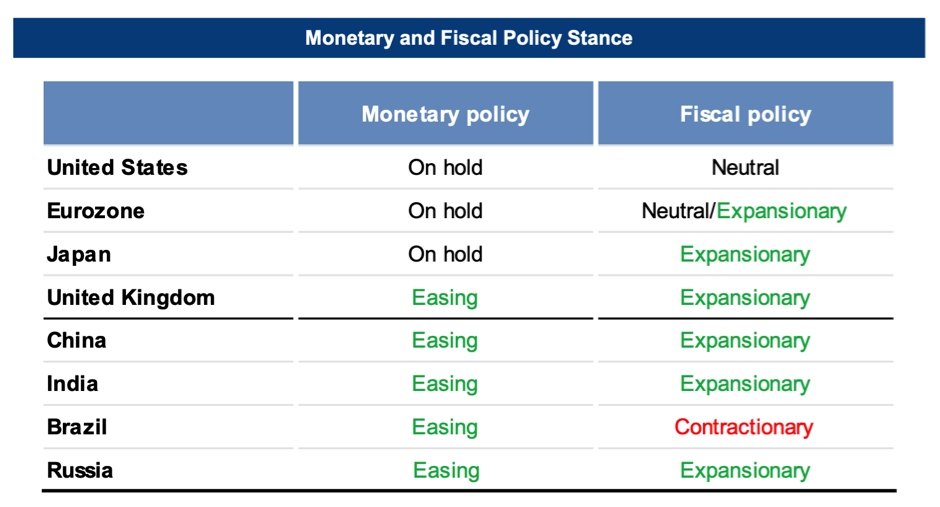

Reserve banks around the world are still in stimulus mode with expansionary monetary policy. This will help underpin asset prices; shares, bonds and houses prices. See the chart below from Goldman Sacs.

Interest rates are very low and likely to stay low for some time.

Immigration is still strong. Net immigration was 55,000 people for the year end October 2019 versus the 10 year average of 29,000. More people need more housing, simple.

A shortage of properties for sale is causing house prices to rise.

This from a recent interest.co.nz article by David Chaston entitled “We have our own special drought – houses for sale”

“Realestate.co.nz is reporting that December ended with a record low number of homes available for sale on their service – just 18,230 and down by a quarter from December 2018.

The scale of the drought in offerings is sharp, and is a long way from the historic high of just under 60,000 homes listed in April 2008.”

Rents are also rising. This is in part due to the shortage of new investment property being developed, but also in response to a change in regulations making some landlords pull their property out of the rental pool in favour of Airbnb. Some are simply switching to Airbnb to maximises their returns by renting to tourism sector.

This from a recent Stuff article by Susan Edmunds entitled “Warning 2020 may be a tough year in rental market”

Trade Me Property spokesman Aaron Clancy said “demand for rental properties was increasing enormously. Unfortunately for tenants, this is a trend we expect to continue in 2020″, he said.

“As house prices continue to climb around the country, tenants are staying in rentals longer to gather a deposit, and that’s putting pressure on the market.

Rental returns remain appealing given the low interest rate environment, with investors hunting for a good return. Property still offers this strong return, even as more costs are imposed on landlords from Residential Tenancies Act amendments and the Healthy Homes standards. With rental demand still outstripping supply, landlords can pass on these additional costs to renters, which is keeping rental prices heading up further.”

Still a good time buy an investment property? Yes.

John Kenel

Assured Property Investments